China banks on Australia’s support in Asia

by Michael Smith in the Australian Financial Review on 5 April 2017

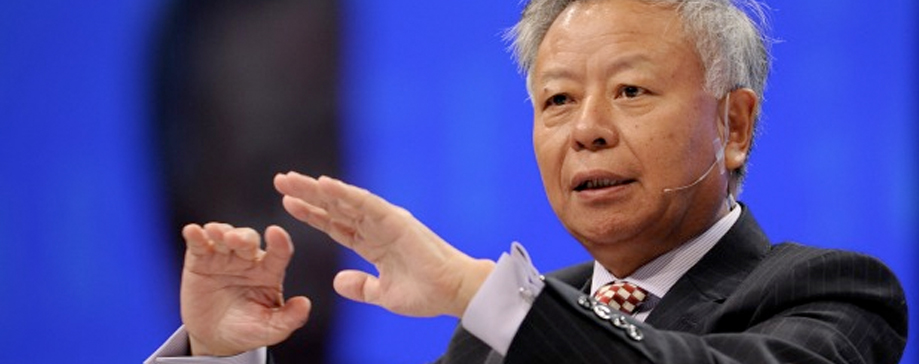

Jin Liqun’s passion for Australian literature is a huge asset for the senior Chinese banker as he sells the merits of the $US100 billion Asian infrastructure bank launched two years ago.

Jin’s bookshelf in his Beijing office features several original sheets from Shakespeare’s plays and works from American writer William Faulkner. He will now add an original first edition of Patrick White’s The Tree of Man to his collection following a visit to Australia this week.

The literary scholar turned banker was presented with the novel, which he translated into Mandarin shortly after the end of the Cultural Revolution in 1979, at a dinner in Sydney on Monday night. After a long search, Global Foundation secretary-general Steve Howard tracked down the 1955 edition in the Grisly Wife bookstore in Beechworth, Victoria, as a gift for Jin who he describes as a “distinguished Chinese internationalist“.

It was a good marketing exercise for Jin, the chairman of the Asian Infrastructure Investment Bank (AIIB), who neatly uses his connection with White’s literature to twin the pioneering spirit of the novel’s central character with the bank’s role as a modern financial institution designed to stimulate investment in crucial infrastructure in the region.

His biggest challenge is convincing the sceptics such as the United States and Japan that the bank will not bow to China’s interests.

As well as China, which initiated the creation of the new multilateral bank in 2014, Jin said the bank represents the interests of the other 69 countries which have signed up for membership. The AIIB has a mandate to invest in badly-needed infrastructure and energy projects in the parts of Asia that need it the most. Its mantra is to be “lean, clean and green” – which is a slogan for its promise to steer clear of corruption and invest only in environmentally-friendly projects.

Australia’s membership in the AIIB was a huge source of political angst in 2015 when former Prime Minister Tony Abbott was initially reluctant to join after the United States and Japan raised concerns. Australia later signed up for membership, committing $930 million in lending.

Despite fears the AIIB was a smokescreen for China’s to exert its influence in region and challenge the relevance of established organisations like the World Bank and the Asian Development Bank, Australia was not alone. Most major European and Asian powers signed up, followed this year by 13 more members including Canada.

There has been a question mark over China’s ability to lead the organisation, which must balance the interests of environmentalists and anti-corruption campaigners while maintaining its credibility with lenders. Jin has been trying to convince Washington of China’s role – while there is no official invite for the United States to join, the AIIB says the door is open.